Vending: the Current State

It’s a familiar scene for anyone in the vending industry: a machine with so many payment peripherals that it’s hard for the eyes to focus. Coin acceptance, note acceptance, card acceptance, media screen, keypad, possibly even an additional device for cashless or closed loop acceptance. What the customer doesn’t know but the operator is well aware of: inside there are countless more devices supporting payment, including a telemeter, audit master, maybe even a diagnostic tool.

Not only does the current market offering of payment technology for vending mean multiple devices from multiple vendors and multiple service protocols, but also yields an unpleasant user and visual experience for customers.

So, how can vending move towards a more streamlined payment model? We’ve compiled our top recommendations for the future of vending payment systems to keep machines simple and users happy.

1. Don't Count Out Cash

Cash continues to play an important role in the vending market. Not only do a majority of consumers prefer cash for purchases under $5 (the vending sweet spot), but cash payment systems have advanced to do more than just count coins.

What does the future of the coin changer look like? Think a changer that acts as an MBD master, can accept closed loop payment, and can even diagnose its own device problems.

What’s more? Having cash in your machine costs you nothing after the initial purchase. No upkeep fees, no connection costs, no processing fees, all while giving your customers the payment flexibility they expect.

2. Streamline With An All-In-One Device

One stone, many birds: the beauty of installing an all-in-one device. Looking at vending payment systems, opting for an all-in-one ePayment terminal provides operators with a streamlined way to eliminate multiple customer touchpoints, as well as reduce service costs associated with having multiple payment devices.

Look for devices that include a screen, all elements of cashless acceptance (closed loop reader, magstripe reader, chip and PIN acceptance, contactless and mobile acceptance, and telemeter). Even better? A card reader that fits directly over your bill validator to accommodate cash and ePayment acceptance in a single payment terminal. With future models incorporating a built-in antenna, operators can even avoid needing to drill additional holes in the machine, all while cutting down on installation time.

The future of payment will rely heavily on new technology trends like mobile and Bluetooth payment, so it’s important for operators to look at future ready solutions that can accommodate these payment types with a simple software upgrade.

3. Think Modular

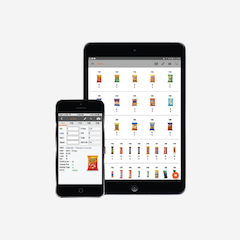

Not ready to go all in with an all in one device? Think about purchasing payment systems that allow you to add on modularly. This can mean starting with coin, closed loop acceptance and telemetry, and adding on a card reader when you’re ready. Not ready to commit to a card reader? Look for a closed loop system that can also accommodate cashless payment via mobile app.

4. Don’t forget about software

Effective payment doesn’t stop at the point of sale. Especially in countries with audit laws, monitoring and proper payment reporting is critical. By opting for a single supplier, you can ensure that all of your payment devices are managed, upgraded, and monitored from a single platform.

The Takeaway

As payment continues to evolve, particularly in the ever-flexible vending space, it’s important for operators to realize that payment is not a one-size fits all game. Customer needs and demands are constantly evolving, and the most effective approach continues to be to accept whatever is in the customer’s wallet—rather than dictate how the customer should pay.

Whatever your payment strategy looks like, CPI is able to work directly with operators to customize solutions to accommodate your best payment solution.